There's an old joke about the millionaire who went bankrupt. "How did it happen?" an old friend asked. "Well, at first it happened really slow and then it happened really fast."

Life’s events have the habit of occurring quicker than we expect. When is the best time to start planning for retirement? Or for buying a home? Or for building an emergency fund? The answer is right now. The earlier you begin developing a financial strategy for your future, the easier it will be and the more successful you will be at attaining it.

Early planning forces people to examine their own financial health and spending habits and to review topics such as:

- Taxes

- Budgeting

- Saving

- Family planning

- Children’s college/university plans

- Purchasing a house

- Retirement

- Estate & Trust planning

Developing good habits early can help form great habits that last a lifetime. A good financial plan, with the help of a financial planner, should include all of your major financial needs including short-term goals and goals that may be decades away.

Short-term Savings and Goals

Let's begin by looking at your emergency fund. According to a Canadian Payroll Association study, 44% of Canadians report it would be difficult to pay their bills if their paycheque was delayed by even one week.

Every situation is different, but you should have some money set aside to handle unexpected needs like job loss or major expenses. How much? Expert advice varies but we would suggest saving for 3-6 months of expenses. If saving that much seems daunting at the moment, remember that even a little bit is better than nothing.

Getting into the routine to save for this fund is important too. Spending money is easy. Developing the restraint to save for short-term needs is a great habit that is useful for a lifetime.

Buying a Home

The path to retirement isn't a straight line and a major purchase like a home can, and should be, part of the financial planning that leads to a secure retirement.

Saving for longer-term goals like a down payment on a home has never been easy. Many millennials are finding it even more difficult than their parents did with higher home prices.

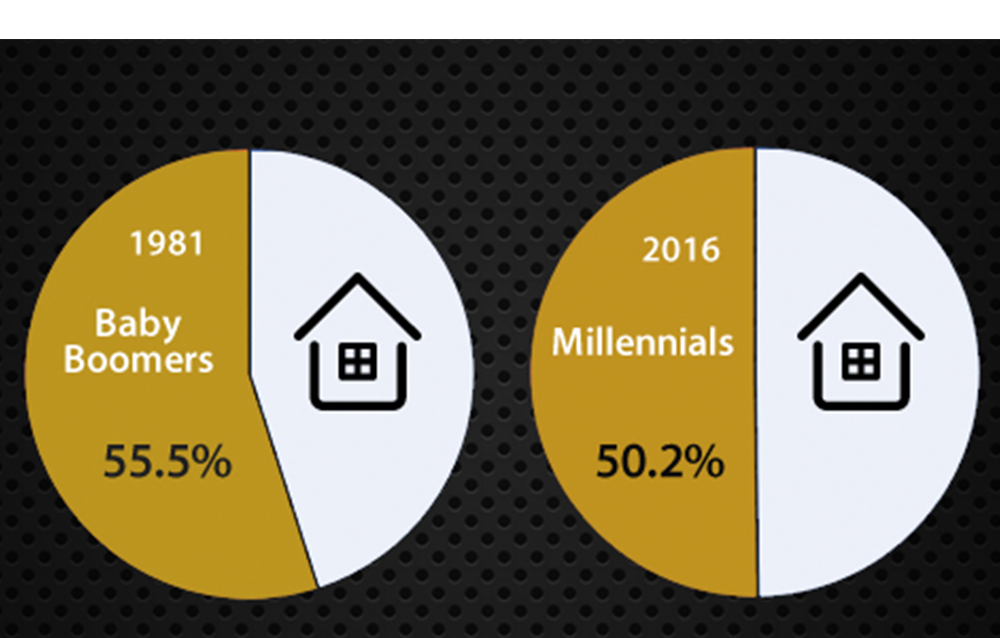

According to Statistics Canada, comparing the home ownership rates of baby boomers at age 30 in 1981, with millennials aged 30 in 2016, just over half (50.2%) were owners in 2016, compared with 55.5% of boomers in 1981.

Making your down payment part of your financial plan will help balance your priorities and make it easier to achieve your goals. Common retirement tools like RRSPs and TFSAs can be used to help save for a down payment on a home.

Did you know that you can use up to $25,000 of your Registered Retirement Savings Plan (RRSP) for a down payment using the Home Buyer's Plan?

As well, a Tax-Free Savings Account (TFSA) is a great way to help save for a down payment. Interest, dividends and capital gains are all tax-exempt once your money is in the account and you won't be taxed when you withdraw it for your down payment.

Saving for Retirement

Goals like building an emergency fund and mid-term goals like buying a home should all be part of a long-term plan that leads to retirement savings.

In a recent CIBC poll, 90% of Canadians revealed they don't have a plan in place to achieve the retirement lifestyle they desire. (That means only 1 in 10 do!)

We've all seen examples of the magic of compound interest. All of the examples demonstrate the same type of result. Slow and steady monthly savings will help build a healthy nest egg for your future. The earlier you begin, the more choices you'll have along the way and the better off you'll be as you near retirement age.

A good financial plan should help you find balance in meeting your short, mid and long-term goals. A wealth advisor is an important part of that plan. Having somebody you trust to help explain, coach and motivate you can be as important as the plan itself.

7 Reasons to Start Financial Planning Early

- Develop Good Habits: It's much easier to work on financial habits early and stick with them later on.

- Starting Early Means Saving Less: The earlier you begin saving, the quicker compound interest helps you in the long run.

- Options, Options, Options: We all like choices and an early start will give you many more options in the future.

- Plan Early, Take on Less Debt: Most of us take on debt throughout our lives, but a smart plan backed with some early savings will help you save on interest payments in the long run.

- Smarter Choices: You're much more likely to live within your means and not make short-term emotional decisions that you may regret later when you’re committed to a plan.

- Look Forward to Your Retirement: Retirement is a life-changing event and you should look forward to it rather than be stressed by the unknowns because of a lack of planning.

- Peace of Mind: A good financial plan should help remove financial stress and let you sleep at night.

As suggested near the beginning of this article, you should work with a wealth professional to help build a financial plan for your individual situation. Contact one of our Wealth Management professionals to help you get started.

Sources for statistics:

- https://www.newswire.ca/news-releases/need-a-source-on-stories-related-to-the-pay-and-financial-health-of-working-canadians-850593207.html

- https://www150.statcan.gc.ca/n1/daily-quotidien/171025/dq171025c-eng.htm

- https://globenewswire.com/news-release/2019/02/13/1724299/0/en/Retirement-Savings-vs-Home-Ownership-1-in-5-Modern-Family-Homeowners-Purchase-a-Home-by-Delaying-Retirement-Savings.html

- https://www.ctvnews.ca/lifestyle/rrsp-season-a-good-time-to-review-your-financial-fitness-1.4284635